ECONOMY

Liquidity set to tighten over a few months amid rising capital outflow, notes CRISIL

- IBJ Bureau

- Apr 20, 2022

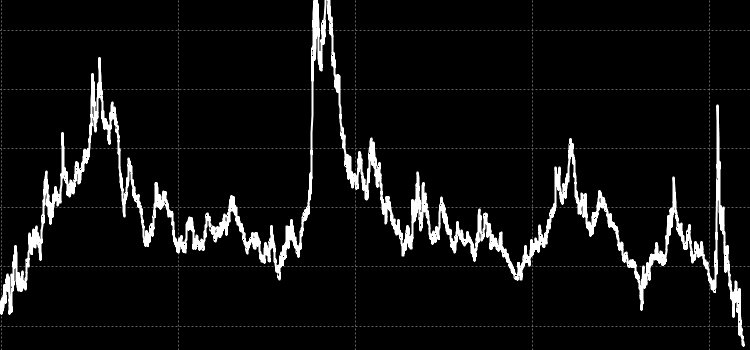

Financial conditions were going to tighten in the country over the next few months due to the likely increase in capital outflows, driven by rising external shocks and domestic vulnerability, CRISIL Ratings said in its report on Tuesday. The agency said that its Financial Conditions Index (FCI) dropped below the zero-mark in March, indicating deterioration in domestic financial conditions.

Besides, State Bank of India and other leading banks have raised their lending rates, which will lead to an increase in borrowing cost.

However, measures to bring down current account deficit and strengthen foreign exchange reserves would help the country to deal with any external shock, the report said.

“Rising external shocks, coupled with greater domestic vulnerability, could increase capital outflows from the Indian markets, resulting in tighter domestic financial conditions in the coming months,” it said.

CTISIL’s index provides a comprehensive monthly update on India’s financial conditions by analysing 15 key parameters across equity, debt, money and forex markets along with policy and lending conditions.

In March, the financial conditions were not only tighter than the previous month but also relatively more stressed compared to the average conditions in the past decade, the agency said.

The country’s vulnerability critically hinged on crude oil prices because they affected its major macroeconomic indicators, including the Gross Domestic Product (GDP), inflation, current account deficit (CAD, rupee and, in some cases, fiscal deficit, it said.

Report By

View Reporter News